In the ever-evolving digital economy, ACT | The App Association’s small business members stand at the forefront of innovation. However, global tax policies shift rapidly, and companies of all sizes face both challenges and opportunities. Regions worldwide are exploring ways to capture tax revenue from digital services, often through digital service taxes (DSTs) targeting major tech firms. Simultaneously, research and development (R&D) tax incentives—critical for fostering innovation and encouraging investment in technological advancements—are under threat. Many countries are revisiting their tax policies, considering rollbacks or reductions in these vital incentives. These conflicting tax policies across regions add complexity for companies operating internationally, requiring careful navigation to stay compliant and competitive.

Our “Digital Tax Follies” blog series dives into the unique approaches to DSTs and R&D incentives across key regions, highlighting the impact on tech businesses, particularly small-to-mid-sized companies. From North America’s resistance to DSTs paired with its history of robust R&D incentives to Asia’s aggressive support for tech growth, each installment will shed light on how these policies shape the global digital economy. Our first installment focuses on the Americas, exploring the differing approaches of Canada, the United States, and Latin American countries like Argentina and Brazil. We examine how these nations balance tax policies with innovation incentives, highlighting what it means for tech companies aiming to expand across borders. But first, some context.

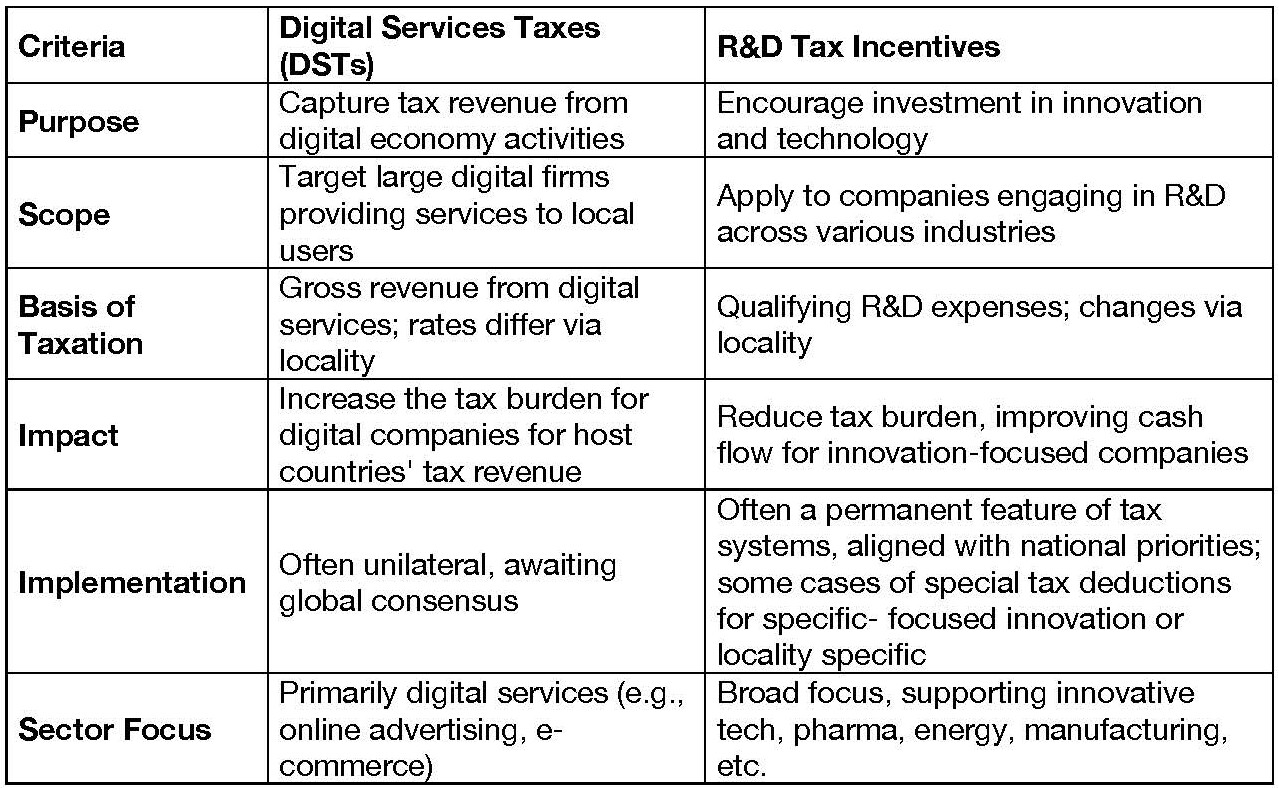

What are DSTs, and why should I care?

DSTs are a relatively new form of taxation introduced in response to the global economy’s digitalization. The digital economy encompasses a range of activities, from software development to hardware production, each of which may be taxed differently depending on the country. DSTs were specifically designed to capture tax revenue from larger, often “non-residential” tech companies offering specific digital services—such as online advertising, e-commerce, digital marketplaces, and social media—to local users. While DSTs aim to address tax challenges from the global digitalization boom, they often complicate and distort business tax liabilities. Certain DST expansions, like consumption tax rates or revenue-specific rates, are seen as disguised attempts to attain additional tax revenue from successful, innovative companies.

With many digital businesses now multinational, the push for multilateral tax agreements has gained traction. However, countries like France, Canada, and Italy have implemented their own DSTs rather than waiting for multilateral proposals like those from the Organization for Economic Co-operation and Development (OECD). These unilateral DSTs impose unique requirements on digital business models, often resulting in distortive and even discriminatory approaches to taxation. Such policies drastically raise compliance costs and create tax confusion for smaller companies lacking full accounting teams. Disagreements over these differing tax codes can also create trade barriers, especially between countries with conflicting transatlantic tax laws. We urge governments to avoid imposing DST rates on cross-border transactions, as these further burden small businesses seeking to operate globally—because every business is global in today’s digital world.

What are R&D tax incentives, and why should I care?

R&D tax incentives have been around longer than DSTs, with many countries adopting these policies to encourage companies to invest in themselves to drive innovation, economic growth, and competitiveness. R&D tax incentives aim to stimulate innovation by reducing the cost of R&D activities. Like DSTs, the qualifications for “activities” differ from locality to locality. However, unlike DSTs, which focus on revenue collection, R&D incentives are a form of government support for businesses. These incentives come in many forms, including tax deductions, credits, and industry grants.

While developed countries often have more robust R&D schemes, many others are now offering lucrative R&D opportunities to encourage tech-focused innovation. R&D tax incentive structures are often permanent fixtures in national tax codes, though some countries have recently introduced temporary “super deductions” on R&D expenditures to spur more tech-centered growth. Many R&D incentives come as either credit—directly reducing tax liability dollar for dollar—or deductions, which reduce taxable income by allowing companies to deduct qualifying R&D expenditures from their gross income. Although deductions don’t lower taxes owed directly, they reduce the income subject to tax, indirectly decreasing tax liability. R&D incentives lower the initial cost of innovation, making it more attractive and affordable for smaller businesses without significant cash flow. These incentives are vital lifelines for small and mid-sized enterprises to offset the financial risks associated with R&D expenditures. Our members urge governments to maintain strong, flexible R&D tax incentives that benefit businesses. Governments should allow immediate tax deductions for R&D expenditures instead of requiring amortization. Such principles are crucial for reducing tax burdens and operational costs, especially for tech companies needing robust infrastructure to develop products and services for consumers.

Key Differences Between DSTs and R&D Tax Incentives

DSTs and R&D Tax Incentives in the Americas

From bustling tech hubs like Silicon Valley to emerging innovation centers in Latin America, governments are grappling with the challenge of taxing the digital economy while fostering innovation. DSTs have emerged as a contentious issue, with countries like Canada and Brazil exploring new ways to capture revenue from tech giants while the United States pushes back against DSTs, framing them as a discriminatory practice. Meanwhile, the battle for R&D supremacy rages on. The United States, the long-time leader in R&D tax incentives, faces new competition as countries like Argentina and Brazil sweeten their offerings to lure cutting-edge research. As policymakers navigate these turbulent waters, the decisions made today will echo through startup incubators for years to come, determining which nations will lead in the digital age and which will be left behind.

Canada

Canada has implemented a dual approach to regulating the digital economy and promoting innovation. It introduced a DST to tax digital giants while maintaining substantial R&D tax incentives.

- DST Rundown

- DST on Digital Revenues

- Canada’s C-59 legislation, effective in 2024, imposes a 3 percent DST on revenues generated from digital services to Canadian citizens.

- This tax targets companies with global revenues over CAD 8 million, affecting activities such as:

- Online advertising

- Digital marketplaces

- Data monetization through user data or digital content

- Trade Concerns: The United States has labeled Canada’s DST as a trade barrier, leading to consultations under the United States-Mexico-Canada Agreement (USMCA). Canada’s DST increases operating costs for large digital firms and could reduce the competitiveness of smaller firms seeking growth in Canadian markets.

- R&D Tax Incentive Rundown

- Scientific Research and Experimental Development (SR&ED) Tax Credit

- This federal tax credit varies by company type:

- Canadian-Controlled Private Corporations (CCPCs): Can claim a refundable credit of up to 35 percent on the first CAD 3 million of qualifying expenditures.

- Other Businesses: Non-refundable credit of 15 percent on qualified R&D expenditures.

- The SR&ED credit applies to in-house and outsourced R&D activities, covering costs such as:

- Wages, software service fees, and contracted R&D development.

- Provincial R&D Incentives

- Additional locality-based incentives are offered, such as:

- Quebec: Up to 30 percent refundable R&D tax credit focused on digital sectors like AI and software.

- Ontario: Eight percent refundable credit for small R&D projects, with limits based on taxable capital and income thresholds.

- British Columbia: Administered through the Canada Revenue Agency, providing refundable credits up to 10 percent for CCPCs.

- Additional locality-based incentives are offered, such as:

- This federal tax credit varies by company type:

United States

The United States is a global leader in innovation, with the highest level of R&D spending in the world; the United States takes a distinctive approach to the digital economy and R&D, focusing heavily on fostering innovation while refraining from implementing a national DST.

- DST Rundown

- International Stance

- The United States opposes unilateral DSTs in other countries, preferring the OECD’s inclusive framework to avoid “double taxation.”

- State-Level DSTs

- Some states have independently implemented taxes indirectly targeting digital services:

- Maryland: Imposed a digital advertising tax with rates from 2.5 percent to 10 percent on digital ad revenue generated from Maryland residents.

- Gross Receipt Taxes: Texas, Ohio, and Washington have adopted gross receipt taxes that may inadvertently affect digital providers generating revenue within these states, creating a fragmented landscape for small companies.

- R&D Tax Incentive Rundown

- Impact of the 2017 Tax Cuts and Jobs Act (TCJA)

- The 2017 TCJA changed the tax landscape by requiring businesses, starting in 2022, to amortize R&D expenses over five years, affecting long-term financial planning for small businesses and slowing operations like recruitment, expansion, and product development. Although the proposed legislation aims to provide temporary relief, it has stalled in Congress as of late summer 2024.

- Federal R&D Tax Credit

- Companies can claim up to 20 percent of qualified research expenses above a base amount, with eligible activities like:

- Software development

- AI algorithms

- Green tech and agri-tech

- Digital platform/e-commerce development

- Alternative Simplified Credit (ASC) allows a 14 percent credit on qualifying expenditures based on the previous three years’ R&D spending.

- Companies can claim up to 20 percent of qualified research expenses above a base amount, with eligible activities like:

- Federal R&D Deductions

- Until the end of 2021, companies could fully deduct R&D expenses in the year incurred. Due to the TCJA lapse, costs must now be amortized over five years domestically and 15 years internationally, discouraging small businesses from early-stage R&D.

- Impact of the 2017 Tax Cuts and Jobs Act (TCJA)

- Some states have independently implemented taxes indirectly targeting digital services:

- International Stance

Mexico

Mexico’s tech ecosystem has evolved rapidly, with a dynamic mix of homegrown startups, regional offices of major global tech companies, and a robust software development sector. The country boasts a skilled workforce and relatively low operational costs, making it an attractive hub for tech innovation, especially in fintech, e-commerce, and software as a service (SaaS).

- DST Rundown

- No official DST, but mainly uses VAT rules to focus on cross-border digital transactions

- VAT on Digital Services

- In June 2020, Mexico implemented a standard 16 percent VAT rate applied to business-to-business (B2B) and business-to-consumer (B2C) transactions.

- Upon registration, nonresident companies are required to collect and remit Mexican VAT on all taxable sales made to customers in the country. Failure to register for VAT or meet the compliance obligations can result in penalties and interest charges imposed by the Mexican tax authorities.

- Digital services include:

- Downloading or accessing images

- Streaming

- Online gaming

- Online marketplaces

- Remote learning/education

- Online journals and newspapers

- For developers targeting the Mexican market, these regulations mean additional compliance costs and administrative burdens on top of the losses in revenue due to the taxes, as they must either manage these obligations directly or partner with a local distributor.

- R&D Tax Incentives Rundown

- R&D Tax Credit

- The Mexican Income Tax Law provides a 30 percent tax credit for R&D expenses, including investments in R&D. The tax credit will be equal to current-year R&D expenses in excess of the average R&D expenses incurred in the previous three years. This incentive cannot be combined with other tax incentives.

- Qualifying R&D projects include those that demonstrate substantial innovation and scientific contributions, which can encompass software development, engineering, and technological research as long as they address a significant technical challenge or uncertainty.

- R&D Tax Credit

Argentina

Argentina’s tax policies adapt to the evolving digital economy while incentivizing innovation in tech, fintech, and software sectors.

- DST Rundown

- No Standalone DST Policy

- Argentina uses VAT rates instead, imposing a 21 percent VAT on digital services provided to Argentine citizens by non-resident companies.

- This VAT applies to services such as:

- Streaming, online advertising, cloud computing, SaaS, and e-commerce.

- R&D Tax Incentive Rundown

- Tax Deduction

- Argentina allows a deduction of up to 150 percent on qualifying R&D expenditures, including activities like:

- Software development, fintech, AI, and other digital innovations.

- Qualifying expenditures cover:

- Salaries, materials, equipment, and outsourced R&D consulting.

- Software Law (Ley de Software)

- Passed in 2019, this law provides software development companies with a reduced 15 percent income tax rate, VAT exemption, fixed employer contribution deductions, and income tax credits.

- To qualify, companies must be registered in Argentina, meet minimum capital investment requirements, and improve export and quality standards.

- Argentina allows a deduction of up to 150 percent on qualifying R&D expenditures, including activities like:

Brazil

Brazil is navigating the complexities of DSTs and R&D tax policies with a cautious approach. While discussions around implementing DSTs are ongoing, the country aims to balance revenue needs with its goal of fostering a vibrant tech ecosystem. Simultaneously, Brazil offers attractive R&D tax incentives, providing significant deductions for companies investing in innovation. As it adapts to global tax trends, Brazil’s decisions will be crucial in shaping its digital landscape and competitive edge in the tech ecosystem.

- DSTs Rundown

-

- As of July 2024, Brazil agreed that non-residential providers for digital services will become liable for collection of new indirect VAT taxes due to start in 2026

- This includes marketplaces or digital platforms acting on behalf of Brazilian non-registered taxpayers or non-resident providers.

- The plan to overhaul its indirect tax system by introducing two new taxes that will consolidate and replace the existing four taxes (PIS, COFINS, ICMS, and ISS)

- CBS (Contribuição sobre Bens e Serviços)

- Will replace PIS and COFINS, applying to goods and services, including digital services

- Will act as a federal VAT consumption tax at 8.8 percent

- IBS (Imposto sobre Bens e Serviços)

- Will replace ICMS and ISS, applying to goods and services, including digital services

- Will act as a state/municipal tax rate of 17.7 percent

- The new proposals also make facilitating marketplaces or similar digital platforms liable for CBS and IBS collections. This is triggered when the platform is responsible for any of the following elements: setting terms and conditions, payments, and delivery. Platforms facilitating just listings or payments are excluded from this.

- R&D Tax Incentive Rundown

- Lei do Bem (Law of Good)

- Law allows for a super deduction of up to 200 percent of qualifying R&D expenditures.

- Qualifying expenditures include

- Salaries

- Materials and tools

- Equipment used

- Outsourced R&D or consulting services

- However, to benefit from the Lei do Bem, companies must be subject to the actual profit taxation regime, a requirement that excludes many small companies operating under the presumed profit regime.

- State-level R&D incentives

- Sāo Paulo

- Offers lucrative grants and subsidies for tech startups and R&D-focused companies

- Minas Gerais

- Provides R&D funding for innovation in agri-tech, AI applications, smart cities

- Sāo Paulo

- Lei do Bem (Law of Good)

Moving Forward

Understanding and adapting to various tax policies is crucial for tech companies aiming to stay competitive. From DSTs that target digital revenue to R&D incentives that encourage innovation, these policies have long-term implications for the success and future of our small to mid-sized companies. As tax policies continue to shift and new regulations emerge, companies must keep a close eye on how these changes could shape their operations and cash flows. Stay tuned for future installments of our “Digital Tax Follies” blog series. Each post will dive deeper into the nuances of DSTs and R&D incentives around the globe. Whether you’re a tech startup or an established player, these insights will equip you with the knowledge to make informed decisions and drive sustainable growth in the digital age.