The current Federal Trade Commission (FTC) and some of its European counterparts are seeing competition problems everywhere, even in the future, in markets that are highly competitive and still emerging. Earlier this year, the FTC blasted several companies competing in artificial intelligence (AI) markets with subpoenas under its 6(b) authority, casting the significant capital investments needed to kickstart AI research and development under the threatening specter of antitrust enforcement. More recently, the FTC suggested that the recent CrowdStrike incident was due to concentration in the market, even though the primary culprit is none other than government regulation addressing possible competition problems in tech markets. Notably, this is exactly the kind of intervention that could result from the current saber-rattling by competition enforcers discussed here. On the other side of the Atlantic, the United Kingdom’s (UK’s) Competition and Markets Authority (CMA) issued a fairly one-sided update report focusing on risks to competition posed by companies providing inputs to AI services, downplaying the costs of intervening to address those risks. Not to be left behind, the Department of Justice (DOJ) and the European Union (EU) signed a joint statement with the FTC and CMA further exaggerating competition risks in AI development.

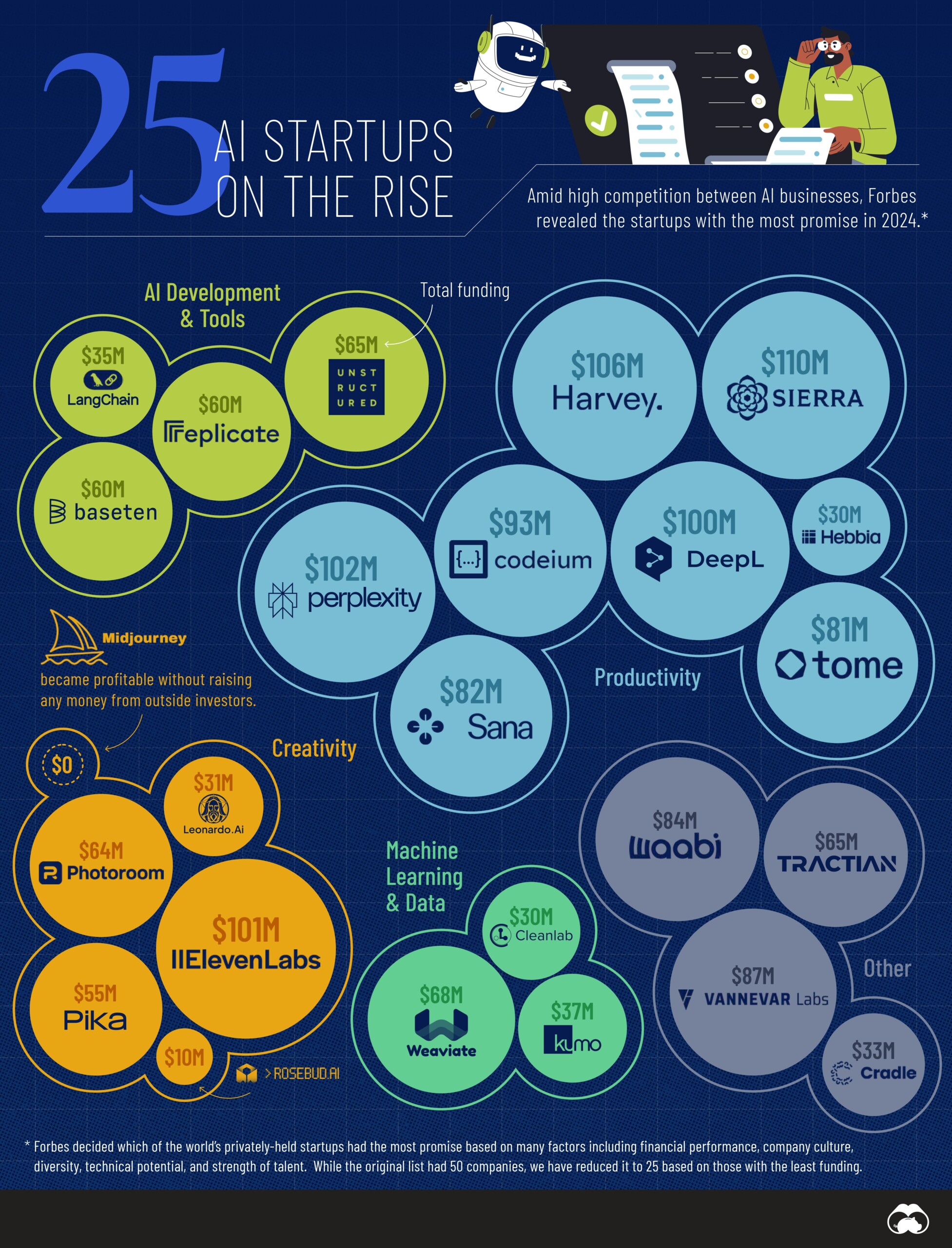

Studying and understanding emerging markets are important aspects of enforcers’ work, but, by ignoring evidence weighing against their foregone conclusions and overstating the risks, these efforts read much more like excuses to intervene later on. The agencies try to cast AI services as somehow more prone to competition problems than other markets with capital-intensive inputs, in part relying on what appears to be an inaccurate picture of the markets for AI services themselves as being dominated by input providers. The present reality of markets for AI services is much different, featuring robust competitors operating in a range of markets for AI services:

Importantly, the illustration here indicates just how much money investors are staking in AI startups, and these are the smallest of the top 100 new market entrants. The reality of these investments foreshadows a future for AI services that is dynamic and competitive, not stagnant and locked up by large companies. We hope that a clearer picture of the market as it exists and as it is likely to evolve will help stave off ill-advised intervention around the world. As small businesses that leverage AI tools every day, competitors in the app economy deserve better than to have their preferences in AI services and prospects as providers of those services supplanted with the aspirations of regulators and enforcers. Minority Report-style efforts to detect and prevent possible future competition crimes, especially when those efforts are based on fiction rather than fact, could upend small businesses’ prospects for years to come.