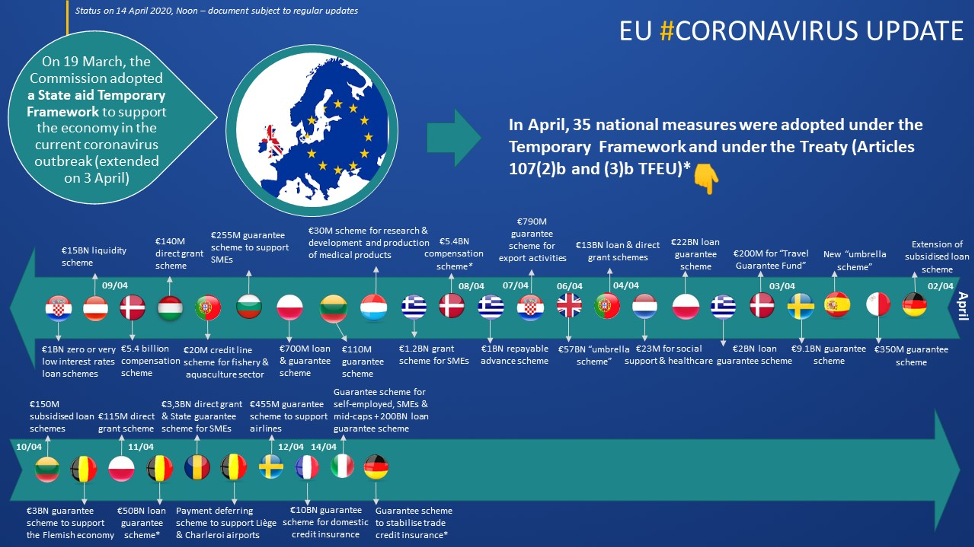

As a result of the COVID-19 pandemic, many small developers and SMEs are experiencing serious financial issues. Because there are so many different national programs for emergency funding and several ways to access them, we are providing you with a high-level overview of the relevant resources some of the hardest-hit member states are offering. In April alone, 35 national measures for state aid were taken across the EU. We also covered resources from the EU itself in another blog.

Source: European Commission

Germany

- The government’s emergency ‘supplementary’ budget of €156 billion includes a €50 billion plan to provide direct grants to SMEs and self-employed persons

- Companies with five or fewer employees are eligible for a one-time payment of €9,000 for three months

- Companies with 10 or fewer employees will receive a one-time payment of €15,000 for three months

- The government also announced it will guarantee 100% of loans up to €800,000 for companies with 11-250 employees to cover rent and other costs

- These will be in the form of federal loans provided by the Kreditanstalt für Wiederaufbau (KfW, Germany’s state-owned development bank) with a 3 percent interest rate

- Merkel’s government is also expanding unemployment support programs (€10 billion), export credits, and allowing companies to defer tax payments

How you can access German resources:

- To receive the one-time payment of €9,000 or €15,000 find your responsible agency here

- You can apply directly for loans (up to €800,000) on the KfW website

France

- France initially appropriated €45 billion but has also committed to unlimited budgetary support for businesses and employees suffering from the impact of COVID-19

- Similarly, the French government promised to show flexibility on corporate tax and social security payments during this time

- Self-employed people and small companies with up to 10 employees can qualify for an immediate monthly grant of €1,500 from a €1 billion “solidarity fund” if they meet certain criteria

- Earnings must be below €1 million a year

- The business had to close OR has lost over 50% of revenue due to the COVID-19 outbreak

- Small businesses facing bankruptcy can apply for an additional €2,000 monthly grant

- Business support in the form of €300 billion in state guarantees for bank loans covered by the state up to 90%, and an additional €1 trillion in guarantees from European Union institutions

- France created a €1.2 billion support program for start-ups, which includes a €500 million fund to prevent the acquisition of French start-ups by non-EU players.

How you can access French resources:

- If you meet the criteria, you can apply on the website of the Direction générale des finances publiques (DGFip)

- Once you have applied, the French tax authorities will automatically deposit the €1,500 grant.

- Emergency loans will go through BPI France, and you can apply online here

Italy

- The Italian government approved a fiscal rescue package of up to €25 billion in early March

- €3.2 billion of which will go to the Italian Health System

- €10.3 billion for the protection of jobs and support income of laid-off workers

- €6.4 billion to help businesses in the form of tax deferrals and postponement of utility bills in affected regions

- €5.1 to support credit supply

- An additional emergency decree was approved on April 6, offering €400 billion of liquidity and bank loans to businesses that are impacted by COVID-19 regardless of size, sector of activity and legal form if they meet the following requirements:

- Companies based in Italy with the destination of the loans requested from Italian factories

- Companies that were not facing financial difficulty as of December 31, 2019 but that have faced or found themselves in a difficult situation following the COVID-19 epidemic

- Companies that have already used the Central Guarantee Fund to full capacity

- The government will protect banks from 90% of potential losses associated with these loans and companies of all sizes are eligible. For loans under €800,000 the guarantee is extended to 100%

- The EC approved a guarantee scheme to support self-employed workers and companies with up to 499 employees.

- The EC approved a €9 billion “umbrella” scheme in financial support to companies of all sizes, including SMEs and self-employed, who weren’t already in financial distress by December 31, 2019.

How you can access Italian resources:

- You can apply for emergency loans through your local bank as explained here

- Under the EC approved guarantee scheme support will be granted through financial institutions in the form of state guarantees and direct grants.

Spain

- €100 billion in state loan guarantees for businesses to ensure liquidity (specifically aimed at helping SMEs through the crisis)

- These public credit guarantees are covered by the government for up to 80 percent for SME loans

- Self-employed persons will receive around €660 a month

- Other measures include a tax deferral for SMEs of up to €30,000 for six months, and additional state support for workers who lost their jobs or who are temporarily furloughed

- The European Commission approved two Spanish guarantee schemes with a total budget of €20 billion for both SMEs and large companies

- The European Commission approved a second Spanish “umbrella” scheme to target both SMEs and large corporates throughout Spain

How you can access Spanish resources:

- Businesses with fewer than 250 employees can apply for loans apply until September 30, 2020

- To be eligible for the tax postponement, express interest to the Spanish Tax Agency here

- Loans of the Instituto de Crédito Oficial (ICO) are available at local banks. Read more here

- If you have lost 75 percent of your earnings you can apply online for the wage support of €660 through Spain’s Public State Employment Service

- Support from the EC approved schemes can be granted in the form of guarantees, subsidized interest rates and equity.

United Kingdom

- The UK government approved unlimited loan guarantees for SME loans of up to £5 million (the government will underwrite 80 percent of those loans)

- There will be a one-year abolition of property tax for all affected sectors

- A “worker retention scheme” where the government pays 80 percent of wages for workers placed on furlough (for companies with reduced activity)

- Bank of England decreased interest rates to 0.1 percent and increased its bond buying program to £645 billion (approximately €735 billion)

- Grants for small businesses up to £10,000 with a rateable value between £12,000 and £51,000

- Grants for self-employed individuals up to £2,500 per month over the next three months

- The UK launched a bailout fund for start-ups with loans of up to £5 million through the new “Future Fund”.

How you can access British resources:

- To participate in the worker retention scheme, you have to have or enrol for PAYE online. Further details can be found here

- For small businesses that are eligible for grants, your local financial authorities are your point of contact

- To defer VAT payments see information here

- Applications for the self-employed grant are not available yet but the government will contact eligible persons and access will go through gov.uk only

- SMEs with turnover of up to £45 million can apply for emergency loans here

- Apply for the Future Fund government loans here.

Belgium

- Belgium’s federal government agreed to a €10 billion stimulus package and €50 billion in guarantees for new bank loans to support small companies and self-employed people

- Other key measures include increasing health expenditures, supporting temporarily unemployed and self-employed Belgians and postponing tax and social security payments

- The Belgian government is granting self-employed individuals a replacement income of €1,266 per month for individuals without dependents and €1,582 for individuals with dependents

- Regional governments have announced several additional measures adding up to €1.7 billion and another €1.8 billion in bank-loan guarantees

- The Brussels, Wallonia and Flanders regions have grant programs for local SMEs

- The European Commission approved a €250 million scheme, financed by the Flemish region, to support start-ups, scale-ups and SMEs.

- The European Commission approved a €25 million Belgian aid scheme to support coronavirus related research and development in Wallonia, covering 80% of the relevant R&D costs for SMEs

How you can access Belgian resources:

- To receive a grant of up to €4,000 for businesses in the Brussels region, check your eligibility and apply here. For more information on Brussels’ COVID-19 response, please read more here

- To receive a grant of up to €5,000 for businesses in the Wallonia region, check your eligibility and apply here. For more information on Wallonia’s COVID-19 response, please read more here

- To receive a grant of up to €4,000 for businesses in the Flanders region, check your eligibility and apply here. For more information on Flanders’ COVID-19 response, please read more here

- For links and further details on the federal response, you can read more here under “federal measures”

Newly added information. If you have questions on how to access these, please contact us!

Austria

- Austria approved a 38 billion support scheme for COVID-19 related unemployment, business support, decreasing tax burdens and to support the tourism/hospitality sector

- The European Commission approved schemes to support SMEs affected by the coronavirus outbreak

- The schemes will provide 100% guarantees for underlying loans up to €500,000 and 90% guarantees for loans up to €25 million.

- Austria launched a special Covid-19 Finance Agency

Bulgaria

- The EC approved a €150 million Bulgarian scheme to support SMEs in the form of equity and quasi-equity investments.

- The scheme will be open to SMEs active in all sectors until 31 December 2020.

- The EC approved a €255 million public guarantee scheme on existing or new loans to support SMEs under the Temporary State Aid Framework.

Croatia

- The EC approved a €322 million Croatian scheme for loan guarantees and subsidised loans to micro companies and SMEs affected by the coronavirus outbreak

- The scheme will be managed by HAMAG-BICRO, the Croatian agency for SMEs, Innovations and Investments.

Denmark

- The EC approved four Danish schemes with a total budget of €130 million to support SMEs affected by the coronavirus outbreak.

- The scheme aims to grant tax deferrals and similar measures in relation to VAT and payroll tax liabilities to ease the liquidity constraints of Danish SMEs

- The EC approved another €130 million Danish liquidity guarantee scheme for select SMEs under the Temporary State Aid Framework.

- The support will be accessible to SMEs whose exports represent at least 10% of their yearly revenue, to the extent they experience or expect to experience a decline in revenue of at least 30% compared to their revenue before the coronavirus outbreak

- The EC approved a €130 million Danish guarantee scheme for SMEs affected by the coronavirus outbreak under the Temporary State Aid Framework.

Greece

- The EC approved a €1.2 bn Greek aid scheme designed to support the liquidity of SMEs facing temporary difficulties as a result of the coronavirus outbreak.

- The scheme is intended to cover interest up to €800 000 per company on existing debt obligations for a period of three months, with an option to extend for another two months.

Hungary

- The EC approved a €1 billion scheme to support the Hungarian economy under the Temporary State Aid Framework.

- The framework aims to support companies of all sizes through direct grants, loans and equity measures.

The Netherlands

- The EC approved a €100 million Dutch subsidized loan scheme to support SMEs

- Public support will take the form of subsidized interest rates on loans and will be accessible to SMEs whose main source of financing derives from external equity, venture capital or microcredit.

Poland

- The EC approved a €1.65 billion recapitalisation scheme to support SMEs and large enterprises affected by the coronavirus outbreak.

- The scheme is part of the wider Polish support programme, “Financial Shield for Large Enterprises,” which has an overall budget of approximately €5.5 billion.

Portugal

- The EC approved four Portuguese guarantee schemes for SMEs and midcaps with a total budget of €3 billion

- These programs aim to limit the risks associated with issuing operating loans to companies that are severely affected by the economic impact of the coronavirus outbreak.

Romania

- The EC approved a €3.3 bn scheme to support SMEs affected by the coronavirus outbreak through direct grants and state guarantees.

You can find a summary of all country measures (compiled by the European Commission) here.

The International Monetary Fund also keeps a running list of policy measures taken around the world.

We will be updating this page as more measures are passed in the coming weeks, but if you have any questions please let us know!