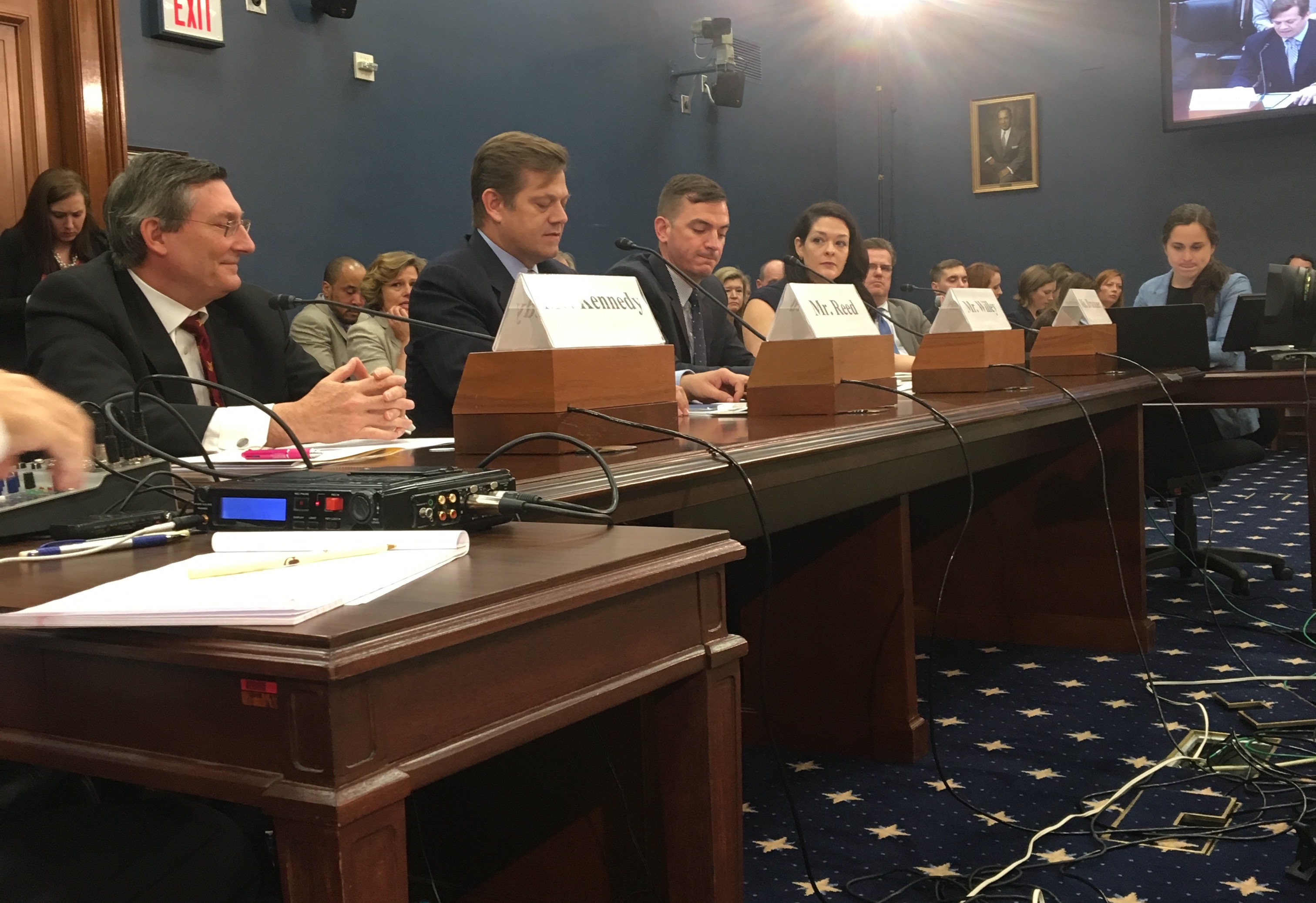

Earlier this week, I testified before the House Small Business Committee at its hearing, “The Sharing Economy: A Taxing Experience for New Entrepreneurs.” The discussion focused on how labor laws and tax policy should evolve to better reflect the American workforce of today.

As executive director of ACT | The App Association, I represent the interests of more than 5,000 app makers and connected device companies across the country. Our members leverage the connectivity of smart devices to create innovative solutions that make people’s lives better. Some of our members are part of the growing sharing economy, which is characterized by peer-to-peer exchanges of goods both digital and physical.

Sharing economy companies have grown rapidly over the past decade thanks to apps that enable instantaneous communication, secure transactions, and personalized relevance for consumers. These same factors allow small businesses and tens of millions of Americans to earn more with flexibility and autonomy via the sharing economy – all powered by the smartphones in their pockets.

But, the economic opportunities created by the sharing economy will cease to exist if companies and individuals can’t effectively navigate federal regulation. Specifically, there are three tax policy actions that I highlighted for the Committee:

- Congress and the Internal Revenue Service should take great care to ensure the federal tax code enables—rather than stifles—the sharing economy. Treating all workers as “employees” under the federal tax code would harm the autonomy and flexibility that underlies the sharing economy’s success. Sharing economy companies don’t tell contractors when to work, where to work, or how many hours to work, and classifying them as employees would diminish the growth opportunity and societal benefits of the sharing economy.

- Small businesses need certainty and transparency in the tax resolution process, including the ability to settle disputes with the IRS in an effective and efficient manner. Legislation like that proposed by Senator Rob Portman (S.2809) can help to ensure this outcome.

- Congress should ensure fairness by guaranteeing that internet sales taxes are based on the seller’s location. Congress should reject proposals that would force businesses to become tax experts for thousands of state and local jurisdictions across the United States.

These concerns are impacting a growing number of entrepreneurs around the country. Forty-four percent of Americans have already taken part in the sharing economy, and by the end of this year the industry will reach $115 billion.

It’s important to note that the sharing economy is far more than a mere repackaging of existing services – it’s a paradigm shift creating new concepts for how people engage and interact.

For example, our member Nomful, a Chicago-based small business, utilizes a sharing platform to connect nutrition coaches from across the country to consumers seeking a healthier lifestyle. Using Nomful’s service, dedicated coaches answer questions, set benchmarks, and help consumers meet their health goals. The company doesn’t merely connect users with a nutrition expert, but instead helps users to change bad habits through ongoing relationships instead of the once-a-month meeting received as part of traditional care.

The only way this works is through a sharing platform – one that allows users to find the help they need and for the coaches to be able to take as many, or as few, clients as they want. In short, creating healthy habits is relationship dependent. Further, Nomful replaces no existing industry.

There is a story like Nomful’s in every single congressional district in America. These companies are part of the revolution taking place – one that is moving high tech beyond just big companies.

But the success of the sharing economy is predicated on an empowered workforce – one where an individual can drive for multiple ride-sharing platforms, open a brick and mortar location while also providing services online, and where platforms must be able to attract users through better training, tools, and clients without triggering a change in tax status.

ACT | The App Association urges Congress to ensure that the rules we follow make sense in an age where the neighborhood yard sale is now nationwide and where a daily client may not live in the same country. The app ecosystem powers the sharing economy and offers incredible benefits to each and every American. I look forward to our continued work together to help advance measures that empower innovation.

Watch:

Other coverage: Fast Company | Morning Consult | The Business Journals