Earlier this fall, U.S. International Trade Commission (ITC) Judge Thomas Pender issued a ruling in an ongoing dispute between Qualcomm and Apple over patent infringement. Administrative Law Judge (ALJ) Thomas Pender’s Initial Determination found that while Apple may have infringed upon a patent owned by Qualcomm, he saw no merit in Qualcomm’s request to ban Apple imports of iPhones using Intel chips. Apple has argued that allowing the import was “in the public interest”– and so far, the ITC agrees. The App Association, which has filed numerous public interest statements with the ITC about this investigation, supports ALJ Pender’s determination.

While ALJ Pender’s decision may potentially be reviewed by the full ITC, we want to take a dive deeper into what Qualcomm’s complaint means to U.S. competitiveness and the internet of things (IoT), and why the public interest exemption we mention above is so important. Further, we aim to share why an ITC ruling on an alleged patent infringement between Qualcomm and Apple is so important to the small business innovator community the App Association represents.

Who is the ITC, and what is the Public Interest Exemption?

A little bit of background: the ITC is an independent federal agency with broad investigative responsibilities on matters of trade, with a responsibility to further the international trading system and U.S. success in it. Among other matters the ITC has authority over, it adjudicates cases involving imports that allegedly infringe intellectual property rights. The ITC also has authority to then exclude products found to be infringing from import into the United States at the border. More specifically, Section 337 of the Tariff Act of 1930 allows a U.S. patent holder to petition the ITC to deny the import and sale of a product using the patent in question in the United States. Not a light sentence by any means.

However, the Tariff Act also requires the ITC to consider “the public interest” in issuing exclusion orders and requires the ITC to refuse to exclude products from import, even if it is found to be infringing, when the exclusion would harm the public interest. Such public interest findings are quite rare: since 1916, when the ITC was created by Congress, the ITC has made only five of them (the last time was in the mid-1980s).

ITC Policy and the Future of IoT, and New 5G Technologies

This investigation has given rise to issues central to maintaining U.S. competitiveness in emerging technologies such as IoT and the deployment of 5G networks, thus impacting countless American consumers. Further, the investigation’s outcome will impact U.S. national security interests as they relate to ensuring a robust domestic supply of trusted cellular components.

The App Association supports ALJ Pender’s Initial Determination, which found that an exclusion order would not be in the public interest. Further, we believe that, should the ITC Commissioners (a possible next step in the review of ALJ Pender’s findings and determination) determine that it will review ALJ Pender’s Initial Determination, we strongly urge that it uphold ALJ Pender’s recommendation not to impose any exclusionary measures on Apple.

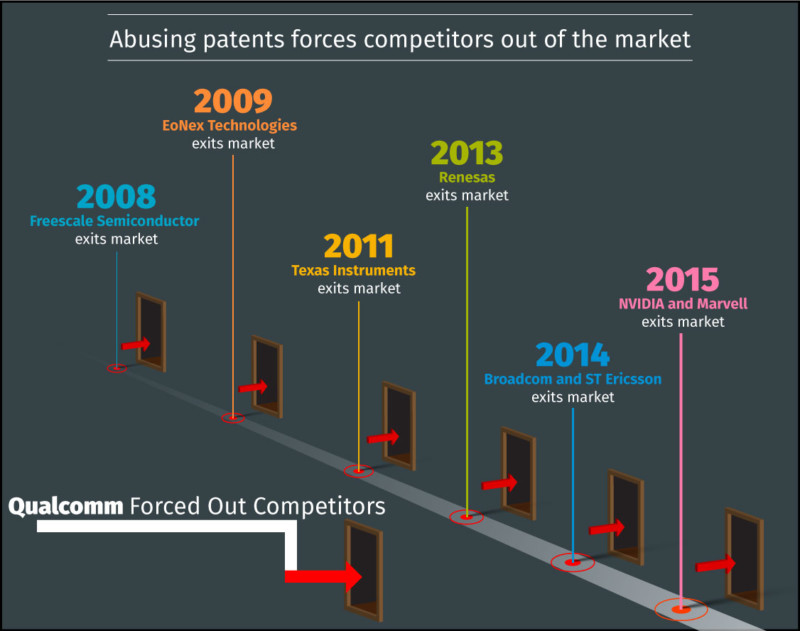

In our filings with the ITC, we have discussed how concerned we are with the effect an exclusion order would have on competitive conditions in the U.S. economy. The facts established in this case show that the relevant market at issue is the premium baseband chipset market. Baseband chipsets are crucial to the diverse and thriving mobile ecosystem as well as the development and deployment of IoT and 5G networks. There are only two competitors in the market for these critical cellular components—Intel Corporation and Qualcomm Incorporated.

As we mention above, Under Section 337 of the Tariff Act, an exclusion order is inappropriate if the negative effect it has on “competitive conditions in the United States economy”—among other considerations—outweigh the benefits of the order. In his Initial Determination, ALJ Pender aptly notes that an exclusion order on all Apple iPhones with Intel baseband chipsets would reduce the number of competitors in the premium baseband chipset market from two to one. In the App Association’s view, allowing only one U.S. competitor in such an important market is unacceptable and would unnecessarily and significantly disadvantage the American people by raising the cost of the mobile, app-driven technology we all use to work and play.

As ALJ Pender notes, the circumstances in this case are “unique and the risk of harm to the public interest is tangible.” We agree and note that this is particularly true for the small, technology-driven businesses that rely on fast, dependable, and evolving networks to reach customers and clients. This mobile app economy is already worth a surprising $950 billion per year and supports 4.7 million jobs, including high-paying jobs in all U.S. Congressional districts. The wide distribution of the app economy across the entire United States—as opposed to its previous concentration in tech hubs like Silicon Valley—is possible thanks to the ever-improving capacity, speed, and technical characteristics of mobile networks.

Much of the market opportunity for small-sized software companies will depend on their ability to leverage small cell networks to transform traditional businesses into agile, mobile-friendly enterprises. But such businesses remain competitive and expand only if network improvements keep pace. These needed improvements are simply unlikely to continue if there is no competition in the premium baseband chipset market.

As one of Qualcomm’s fact witnesses in this case noted, premium baseband chipsets are “really where you introduce all the new features.” A witness for the opposing party agreed, observing that premium baseband chipsets “have all the latest features and comply with the latest releases of the standards.” A monopoly created by an exclusion order would remove the core incentives for the remaining chipset producer to create the best and fastest versions of hardware that all parties agree is a keystone of network innovation. This is why we have strongly urged the ITC not to create an artificial monopoly that depletes American ingenuity and competitiveness in this crucial market, especially at a critical time when 5G deployment is just starting.

Retaining America’s Competitive Edge

Competition in the premium baseband chipset market is not just important for the millions of jobs next-generation networks support, but it is also crucial to national security. We agree with ALJ Pender that a lack of competition in the premium baseband chipset market would lead to higher prices, lower quality, and a general slowdown in American development of 5G technologies. With China surging forward and ordering government-directed investment in 5G, the United States cannot afford to slow down. Tapping the brakes on 5G by eliminating competition would be a gift to China, allowing it to set terms and create the core technologies on which the rest of the world—including the United States—would be forced to rely.

If China controls development of critical cellular components, it can engineer them to contain vulnerabilities that could be exploited to illicitly access U.S. citizens’ information and introduce computer viruses to undermine U.S. infrastructure. Such dangers are clear and present, and a situation where Chinese interests are woven into 5G network technologies compromises the security of potentially all private and public uses of U.S. networks. This outcome is unacceptable and allowing it would be bad public policy. We urge the ITC not to issue an exclusion order banning imports of iPhones using Intel chips. The “public health and welfare”—that is, national security—would be put at great risk by the elimination of U.S. competition in 5G.

We continue to wait for the ITC to announce whether it will review ALJ Pender’s Initial Determination and will continue to pay close attention to this case and its implications for American small business innovators. By focusing on enhancing U.S. competitiveness, the ITC can ensure it advances trade, and, more importantly, protects the public interest.